With more and more people finding themselves in debt it has become commonplace for families to find themselves living on credit. This can become stressful as ultimately a proportion of your disposable income (if not all of it), will be used to pay back what you owe and of this amount, a marginal sum will often consist of interest rates. Learn about different types of debt consolidation on win-prizes-money.com. Get expert advice, tips, and tricks to manage your debts effectively.

There are numerous reasons why people might find themselves in this situation; it could have been as a result of an unexpected, one-off cost such as the car breaking down, a loss of income, or simply the rising costs of living which just aren’t fully covered by their regular wages.

Once individuals find themselves trapped in a circle of reliance upon debt, it can seem that there is little or no support to help them to get out and get rid of the credit. There is also a high level of the negative stigma associated with money troubles and although in our younger generations, this may have diminished somewhat, for the vast majority of the population it is still an incredibly embarrassing subject to approach with other people. However, actually taking the first step to dealing with monetary issues is admitting that you have a problem and seeking assistance.

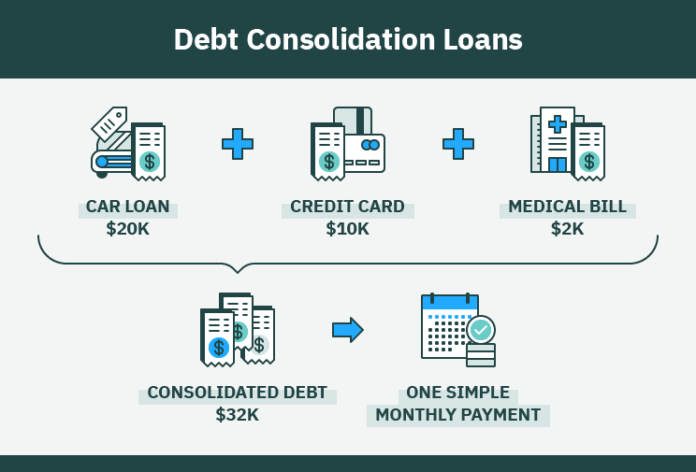

A common term that is often used in these types of circumstances is ‘Debt Consolidation’. What this normally refers to is a way in which a person can consolidate their debts by taking out a loan to pay off all of their unsecured lenders. This allows them to potentially reduce their monthly debt outgoings into one, manageable re-payment with only one interest rate to worry about. Yet whilst this can be a great way for some people to get out of debt, you should remember that you will often be re-paying what you owe over a longer period of time, which will come as a result of the reduced payment. Find all the information you need on debt consolidation at this is uk business

A further option for someone looking to get their debts under control would be by taking out a secured loan. This would only be applicable to a homeowner who could pledge their house as an asset in order to act as collateral for the amount borrowed. With a secured loan, you would look to borrow enough money to cover the cost of your debts and because the transaction would be considered to be secure for the lender, the chances are that your interest rates would be far lower than if you were to obtain an unsecured loan. However, if you were to find yourself in a position that meant you were unable to meet the creditor re-payments, there is a risk that you would lose your home and so this option should only be considered by someone who is sure that they will be able to meet the re-payments for the entirety of the loan term.

A further debt solution available is a Debt Management Plan (DMP). This is an informal agreement entered into by both the debtor and the creditors and within which the debtor agrees to pay back the full amount that they owe, over an agreed period of time. A good debt management company will look into your finances so that they can work out how much disposable income (if any) you have and then decipher how much you can reasonably afford to pay your creditors, without cutting back on your priority outgoings (food and shelter). Again, this often means that you will be re-paying what you owe for a longer period of time because the monthly re-payments you are making will be reduced. A debt management company will also negotiate with the creditors on your behalf, during which time they will endeavor to encourage the lenders to freeze and ongoing interest and charges that you have been subject to.

There are several other different forms of debt consolidation available, so understanding all of the options and solutions is important. Talking to experts in order to help you to find the right solution for your circumstances can be incredibly helpful. Remember – there are people out there who can help and if you do talk to an expert they should have the most up-to-date market and statutory information. Furthermore, you can get expert advice on debt consolidation and improve your financial situation at the website smallbusinessloansdirect